Some Ideas on Fast Payday Advance You Should Know

An increasing number of customers select our funding items to cover unexpected expenses or bridge a short-term money crunch in between cash advances without incurring revolving financial obligation. Depending on your state, financings are readily available in shops, online, or both.

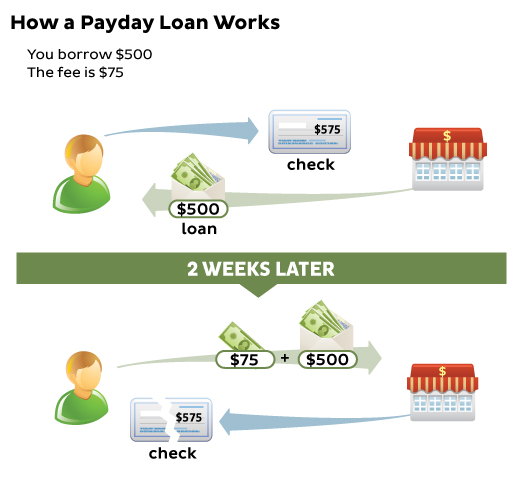

The typical lending term is regarding two weeks - Payday Direct Loans. Loans normally set you back 400% annual interest (APR) or extra.

Consumers default on one in five payday finances - Check Cash Payday Advance Loans. Cash advance financings are made by payday financing shops, or at stores that market other economic solutions, such as check cashing, title lendings, rent-to-own as well as pawn, depending on state licensing requirements.

The Customer Financial Defense Bureau implements the MLA regulations. To file an issue, click below. See: CFA news release on changed MLA guidelines.

Unknown Facts About Check Cash Payday Advance Loans

That's why we've created this brief overview to help you learn the ins and also outs of what they are, just how they function, and also whether you should consider them. A payday advance is a small, temporary loan meant to cover unforeseen expenditures that can not wait up until you receive your following paycheck.

Let's state that you have an unexpected vehicle fixing of $300 that you need to pay for, however you do not get paid up until the end of following week. Fast Payday Advance. You require to have your car fixed prior to then to reach work, but you're living paycheck-to-paycheck, as numerous Americans do.

It is essential to note that payday advance can pass other names also, including money development car loans and check development lendings. Check Cash Payday Advance Loans. Payday lending institutions offer money with the assumption that you will certainly repay the full amount of the lending when you get your following income. You may be called for to compose a postdated check constructed out to the lending institution for the sum total of the car loan plus charges.

Lenders do this to make sure that they will certainly obtain their money (plus charges) after your next cash advance. An essential thing to understand about cash advance is that there are state regulations that play a big part in whether you can get a payday advance. Actually, payday advance aren't permitted at all in some states, consisting of Arizona, Georgia, and also New York City.

Fast Payday Advance Can Be Fun For Everyone

Most states that permit payday financings are strict concerning what money costs lenders can affix to payday finances. State laws likewise identify the optimum car loan quantity as well as the loan terms that loan providers can provide (Check Cash Payday Advance Loans).

You can likewise see an influence on your credit rating if a payday loan provider submits a legal action against you to gather the overdue financial debt. Most states that allow payday advance have a capped maximum loan amount, so the amount that you can borrow depends a great deal on where you live.

States that have loan caps see this as a means to secure customers from the high price and also brief repayment terms of cash advance. Sometimes, you may be able to get greater than one payday advance each time. Nonetheless, this is normally a poor idea as it can cause a cycle of financial obligation if you aren't able to pay off the amount in full without reborrowing.

There are pros and cons to weigh if you're considering applying for a payday lending. Cash advance car loans can provide you with quick cash, occasionally also within the exact same day that you applied.

Facts About Payday Check Loans Uncovered

Not to be confused with a cash advance, an income advance is something that you might have the ability to obtain directly from your company. Some companies will certainly permit you to get an advance of your paycheck without charges connected. If you require quick money to hold you over up until your following income, it may be a good concept to ask your manager concerning this alternative.

Individual finances are typically available in bigger amounts than payday car loans. They're likewise installment financings, so you can repay them with taken care of monthly repayments over years instead of the brief turnaround time for settling a payday advance loan. Personal loans often tend to come with reduced passion prices than payday financings.

The plus side of this is that if you repay your individual loan on time, it can assist you build your credit score as well as raise your credit rating. We can't tell you whether a payday advance is ideal for you, but we can assist you ensure you recognize every one of your options if you require aid making it to your next paycheck.

Before you obtain one, it is necessary to understand what you'll obtain as well as what's anticipated from you in return. Cash advance work in a different way than personal and other customer lendings. Depending upon where you live, you can obtain a payday advance online or via a physical branch with a payday loan provider.

Some Known Factual Statements About Payday Check Loans

Some states ban payday advance completely. When you're accepted for a cash advance, you may receive cash or a check, or have the money deposited into your savings account. You'll then need to repay the loan completely plus the finance fee by its due day, which is usually within 14 days or by your next paycheck. New Direct Loans.

By using this site you agree to this Privacy Policy. Learn how to clear cookies here

Car Transportation A1 Auto Transport: De Veilige en Betrouwbare Keuze voor Uw Voertuig Efficient Techniques On Mould Removal Lote jardim botanico पैंट প্যান্ট FOR FRENCH CITIZENS - United States American ESTA Visa Service Online - USA Electronic Visa Application Online - Centre d'immigration pour les demandes de visa américain 365 staffing agency бензиловый спирт цена Arshad Qazi